RACV

Rescuing the rescuers

THE PROBLEM

Dwindling sales of roadside assist

RACV were facing a decline in roadside assist sales. They were looking to us for insights into causes of the problem and ideas on how to make the product more appealing.

THE APPROACH

Double diamond

deep dive

To really understand the issues with this process we used the double diamond methodology. We conducted a holistic, landscape review along with qual and quant research.

To understand completing an insurance quote we reviewed the form and it’s data, spoke to customers, shadowed staff, and looked at what others are doing. All to uncover the customer problem behind their business problem.

THE RESULT

3 standout problems, & suggestions

We came up with a list of 15 issues affecting the success of the insurance form, and with that 26 recommendations.

However 3 of these issues and solutions have the most impact and we will only be unpacking those here.

Only 2% of customers complete the form and each page has an average 20% drop off

Problems and Solutions

26 questions to estimate your home’s rebuild cost

Currently it takes all these questions to calculate the cost to rebuild your home. However at no time in the process are you made aware of why all these questions are being asked. Some people wont mind answering all these questions, but for some each question is an opportunity to lose a customer.

Each question could be one question too far. So rather than accepting the status quo it would be good to challenge and see if we really need all of them?

How might we... gather information in a way that doesn’t feel too demanding?

1 the solution

One question

at a time

One question at a time means users aren’t overwhelmed and they feel like they’re progressing quicker. Also where possible the questions were made binary and given big chunk easy to hit buttons.

For questions with very common answers the button sizes were varied so that the popular answers were larger.

1 the problem

Insurance price may be double by mistake

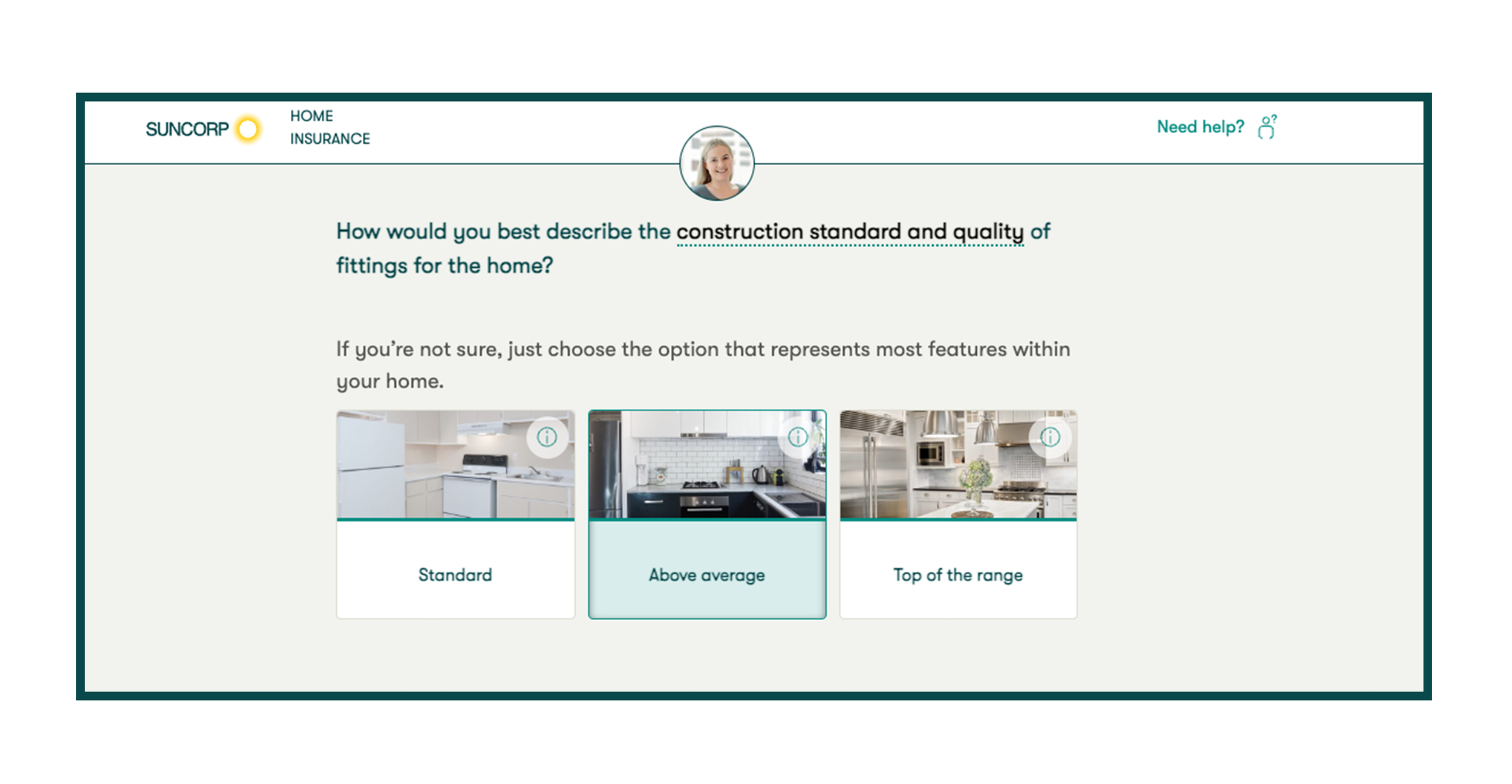

There are several questions that are ambiguous, like the question below. The answer is highly subjective. Those being interviewed weren’t sure how to rate their home and were unaware of the impact of the question

We found the cost to rebuild could be 95% higher depending on the answer given to this one question. When we delved deeper with our interviewees, we discovered the construction quality in their home was usually standard, although to them it was Top of the Range.

Understandably the insurance premium would also be substantially higher. Therefore people may be surprised by a much higher quote than expected, and reject Suncorp as a potential insurer. All due to an ambiguous question.

How might we…gather information

in a way that doesn’t feel too demanding?

2 the solution

Use images to give guidance for subjective questions

Showing an image of an “Above Average” kitchen or “Top of the Range” bathroom gives the customer something to compare against.

2 the problem

Up to 24% of customers abandon as quote page is overwhelming

When a customer gets to the end of the quote process they are not presented with one final quote but three. This is confusing as they are overwhelmed with information.

In advertising, clients are advised to state one clear message. One message has a greater chance of hitting home than three. The same goes here. It’s also unclear what the difference between each quote.

How might we... make it easier to understand the different quote amounts and price options?

3 the solution

Optional extras can be chosen one at a time.

Currently there are three levels of cover you can choose. Each level includes various extras, such as flood or hail damage. Some types of cover, such as Accidental Damage or Motor Burnout, are only available if you opted for the premium insurance plan.

This forced people to opt for a more expensive insurance package they might not need. Again resulting in a much higher price and creating an opportunity to lose a customer.

Instead we have a basic insurance policy with basic features. If customers want to add features they can simply switch them on and off Essentially we are removing the complicated levels of cover and presenting just one quote amount with optional extras.

3 the problem

SUMMARY

Just the highlights

Those were the three biggest pain points in this project. But it was a considerable investigation. If you want more detail free check out the case study

MORE CASE STUDIES